Businesses have been using automation for years to boost efficiency, but traditional rule-based systems can only go so far. Many real-world tasks are too complex to be neatly defined by rules. That’s where AI agents come in.

Unlike conventional automation, AI agents use large language models (LLMs) and generative AI to understand context, interpret natural language, and make independent decisions. This shift is pushing automation beyond rigid workflows and into a future where systems can adapt and respond dynamically.

There’s a common misconception that AI agents will replace robotic process automation (RPA), but that’s not the case.

In reality, RPA and AI agents work best together. RPA is great at handling structured, repetitive tasks, while AI agents are built to manage ambiguity and problem-solving. Together, they create a powerful combination that makes automation more capable than ever before.

So, what are agents?

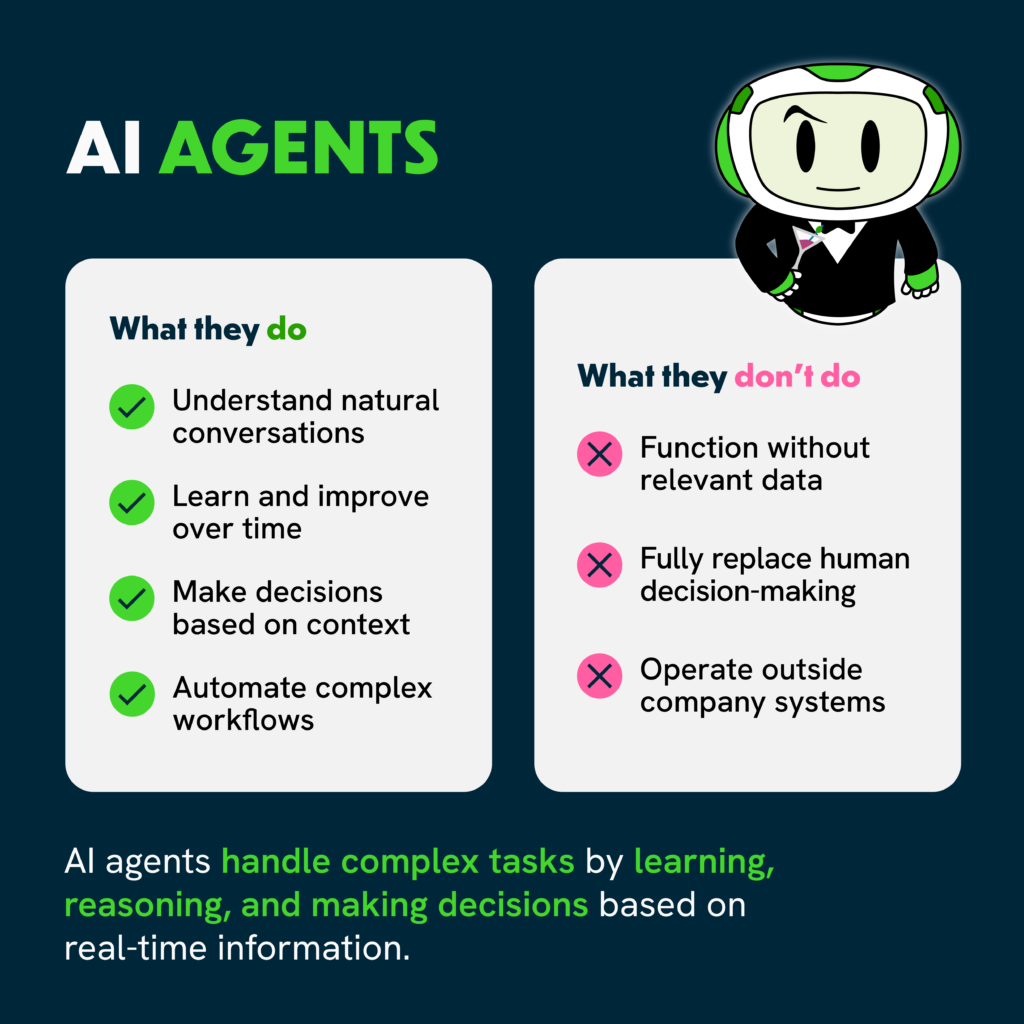

AI agents, sometimes called intelligent agents, are digital workers designed to operate independently. Unlike traditional automation that follows a strict set of instructions, AI agents work with high-level objectives and figure out the details themselves. This means they can adapt to changes, make real-time decisions, and complete complex tasks with minimal human input.

Powered by generative AI and LLMs, AI agents can process unstructured data, understand human language, and interact with other systems naturally. They can be integrated into business workflows to handle customer service, process documents, and automate decision-making, improving both speed and accuracy.

The best part? AI agents don’t require deep technical expertise to set up. Thanks to no-code and low-code platforms, companies can deploy AI agents quickly and start seeing results without major development work.

From AI Chatbots to AI Agents to Multi-Agent Systems

AI automation has evolved rapidly, moving from basic chatbots to more autonomous AI agents, with multi-agent systems emerging as the next frontier. Capgemini highlights this progression:

- AI Chatbots: Early chatbots simulated human conversation but followed predefined scripts, limiting adaptability.

- AI Agents: More advanced, these agents can make decisions and take actions independently. Most businesses are currently at this stage.

- Multi-Agent Systems: The next step is multiple AI agents working together to solve complex problems dynamically. While some industries are experimenting with them, widespread adoption is still developing.

This shift from rigid, rule-based automation to intelligent, adaptable AI systems is unlocking new efficiencies for businesses aiming to scale operations.

AI Agents in Key Industries

AI agents are already making an impact in different industries, improving efficiency, decision-making, and customer experiences. Here’s how some organizations are using AI agents today:

AI Agents in Financial Services

Financial institutions operate in fast-paced, highly regulated environments where accuracy and efficiency are critical. Managing payments, loans, and fraud detection requires quick decision-making and minimal errors. AI agents help financial institutions streamline complex workflows, reducing manual work and improving customer experiences.

One standout example is auto loan adjustments, where AI agents are driving real improvements. Senso, a technology company specializing in AI solutions tailored for the financial services industry, utilizes their pre-built AI agent, Agent Echo, to enhance customer service workflows by analyzing real-time conversations, identifying financial concerns, and suggesting proactive solutions. In auto loan adjustments, Agent Echo helps with:

- Payment Scheduling: Detecting patterns in customer inquiries and proactively offering payment date adjustments to prevent early or late transactions.

- Payment Modifications: Identifying customers at risk of financial hardship and recommending tailored solutions like principal-only payments, “skip-a-pay” options, or extended terms.

- Loan Servicing: Ensuring that extra payments are correctly allocated to principal versus finance charges by interpreting customer intent and improving accuracy in loan adjustments.

By using AI agents, financial institutions can streamline processes, improve customer service, and reduce the manual workload on employees.

AI Agents in Healthcare

Healthcare organizations deal with large amounts of unstructured data, from patient records to insurance claims. Traditional automation struggles with messy, inconsistent data formats like handwritten notes and scanned documents. AI agents are changing that.

Dr. Edward Challis, Head of AI Strategy at UiPath, explained in UiPath’s recent quarterly webcast, UiPath Live: The Path to Agentic Automation, “Agents offer a powerful way to handle tasks where data is constantly changing.” AI agents in healthcare can:

- Extract Key Details: Parsing handwritten physician notes, blurry forms, and non-standardized claims to structure data properly.

- Ensure Compliance: Automatically cross-checking extracted data against regulations to reduce compliance risks and errors.

- Improve Efficiency: Processing claims faster and reducing manual workload, leading to quicker approvals and lower costs.

With AI agents, healthcare providers can cut down on administrative burdens and provide better service to patients.

How can I be sure my agents won’t go rogue?

One of the biggest concerns with AI agents is ensuring they operate safely and predictably. Because AI agents make their own decisions, businesses need to have the right guardrails in place to prevent unwanted behaviors.

To ensure AI agents operate reliably, businesses should focus on:

- Keeping humans in the loop: AI agents should have oversight so that humans can step in when necessary.

- Continuous monitoring: Tracking agent behavior regularly to ensure they follow business rules and objectives.

- Partnering with trusted vendors: Working with established AI providers ensures security, compliance, and consistent performance.

Inside UiPath’s Agentic AI Summit and Product Launch

On March 25, at the Agentic AI Summit, UiPath unveiled its next-generation agentic tools. With Agentic Automation in the spotlight, UiPath employees, customers, and partners shared valuable insights into key components like Maestro (Agentic Orchestration), Test Cloud (Agentic Testing), and Agent Builder (Enterprise Agents).

Missed the summit? We’ve got you covered. Download the session slides to catch up:

This launch marks a major milestone in making AI-powered automation more accessible and effective for businesses of all sizes.

What if my AI agent isn’t from UiPath?

AI agents are designed to be flexible, much like APIs that integrate across multiple platforms. Many business applications will likely develop their own frameworks to help companies build and manage AI agents.

That said, using a platform like UiPath Agentic Orchestration (also known as UiPath Maestro) can help businesses manage AI agents, RPA bots, and human workers more effectively. With Agentic Orchestration, companies can:

- Connect AI agents, RPA bots, and employees in one seamless system.

- Turn disconnected automated tasks into structured workflows with human oversight.

- Simplify process management and accelerate automation across the organization.

The Future of AI Agents

AI agents are still evolving, and we’re just scratching the surface of what they can do. In the near future, we can expect AI agents to handle even more complex workflows with minimal human oversight, more businesses to use real-time AI-driven decision-making in their daily operations, and increased efficiency as AI agents continue to refine and optimize processes on their own.

AI-powered automation is moving fast. Are you ready? Watch UiPath’s agentic launch from March 25 to see firsthand how AI agents are shaping the future of business automation.